IMC Group President Says Tool Value Comes from Productivity

Only cutting tool productivity can reduce other factors affecting part cost. Jacob Harpaz made this point at a recent Ingersoll Cuttings Tools event in Cleveland.

Share

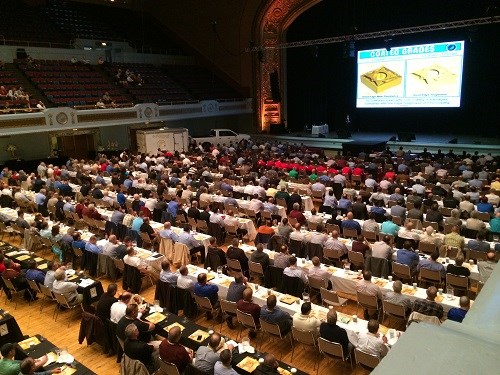

The Ingersoll Cutting Tools event was held at the historic Cleveland Public Auditorium.

An improved cutting tool could deliver its improvement in any of three different ways. That tool could be cheaper, it could provide longer tool life or it could deliver greater productivity. IMC Group President and CEO Jacob Harpaz says go for the productivity. Now is the time for this.

That was his message at an Ingersoll Cutting Tools 125-year anniversary event last week. The event was held in Cleveland, birthplace of the cutting tool company. Now based in Rockford, Illinois, Ingersoll is today part of the IMC Group, which also includes cutting tool makers such as Iscar, Taegutec and Tungaloy. In presentations throughout the day-long event, Mr. Harpaz described various offerings in Ingersoll’s milling, turning and holemaking lines to an audience of about 850.

Business is good. After Ingersoll’s sales dropped in ’09, following the crash, the company had sales in ’10 that surpassed ’08. Then, after a flattening from ’11 to ’12, business has been increasing through the past two years. All of this is relevant to his message because many machining facilities have seen something like this same pattern of activity. Business is now strong enough in machining, particularly in North America, that any open time on a plant’s machine tools often can be filled. That means far and away the most lucrative return to get from a cutting tool is an improvement in productivity.

Shops do not necessarily see this, Mr. Harpaz says. Because a cutting tool is a consumable that is purchased again and again, its price is seen frequently, and therefore seems more significant than it might be. In most manufacturing processes, the impact of fixed costs and labor costs are actually much higher.

Specifically, for a representative machined part, he says the cost of machinery represents 26 percent of the cost of machining a part. Overhead represents 21 percent of the unit cost of machining. Labor and raw material account for 28 and 22 percent, respectively. Meanwhile, the cost of cutting tools accounts for just 3 percent.

That such a low share of the total cost comes from cutting tools has significant implications. Dropping the price of the tool by 20 percent, as big a change as this might seem, would deliver only a 0.6-percent unit cost reduction. The seemingly even greater change of increasing the life of the tool by a factor of 2 would save only 1.5 percent. But increasing productivity would increase the number of pieces the shop can produce in the same period of time, meaning the labor cost, overhead cost, and machinery cost per piece all go down. Increasing productivity by 20 percent thus produces a savings of 15 percent overall. Productivity increase delivers far and away the greatest savings, he says, because it is the only type of cutting tool improvement that can affect all the other cost factors.

The Ingersoll event showcased various new or improved cutting tool offerings aimed at this productivity increase. For example, the company’s TC430 whisker-reinforced ceramic insert for turning superalloys is more expensive than carbide tools used to turn these metals, but it is so much more productive that the cost increase is easily justified. (See of the tool turning Inconel.) A couple of the company’s unusual offerings for productivity include:

- The Chip Surfer milling tool line, which consists of tools with . The time savings here comes from quickly being able to replace a worn tool or switch to a different tool type just by changing the tip.

- Coolant-driven spindles able to deliver 40,000 rpm on a lower-speed machine for small tools requiring this rotational speed.

The most prominent product line at the event was the company’s “Gold Rush” line, which consists of tools benefiting from a post-coating treatment that enhances performance. Tools in this line can deliver long tool life compared to tools without the surface treatment. However, the more profitable use of the tooling is to let tool life remain steady, he says, and instead use the performance enhancement to increase speed and feed rate. Now is the time to go for productivity.

Related Content

Sandvik Coromant Milling Tool Boosts Productivity in Steel Machining

CoroMill MR80 is designed for challenging roughing operations in a wide range of face and profile milling applications in steel and stainless steel.

Read MoreOSG End Mills Provide High-Efficiency Milling

The company has expanded its range of end mills with two offerings for high-speed milling.

Read MoreShoulder Milling Cuts Racing Part's Cycle Time By Over 50%

Pairing a shoulder mill with a five-axis machine has cut costs and cycle times for one of TTI Machine’s parts, enabling it to support a niche racing community.

Read MoreKennametal's Expanded Tooling Portfolio Improves Performance

The company has launch eight new products that expand on and support existing platforms across multiple applications.

Read MoreRead Next

AMRs Are Moving Into Manufacturing: 4 Considerations for Implementation

AMRs can provide a flexible, easy-to-use automation platform so long as manufacturers choose a suitable task and prepare their facilities.

Read MoreMachine Shop MBA

Making Chips and 91ÊÓƵÍøÕ¾ÎÛ are teaming up for a new podcast series called Machine Shop MBA—designed to help manufacturers measure their success against the industry’s best. Through the lens of the Top Shops benchmarking program, the series explores the KPIs that set high-performing shops apart, from machine utilization and first-pass yield to employee engagement and revenue per employee.

Read More