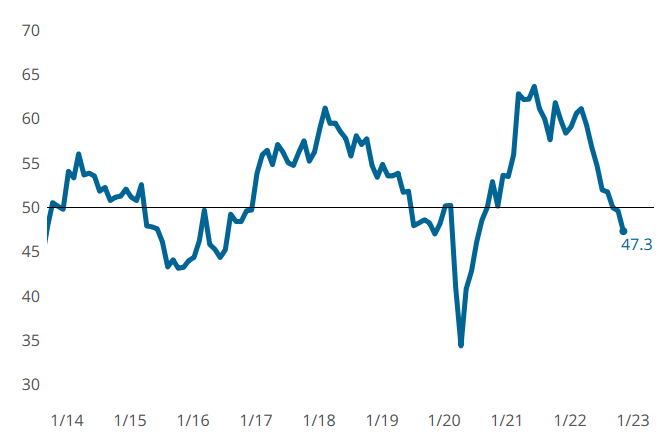

Metalworking Activity Contracted in November

Contraction was hard to dodge with metalworking activity expansion steadily slowing since March.

Share

Metalworking GBI is down, having solidly contracted in November. Photo Credit: Gardner Intelligence

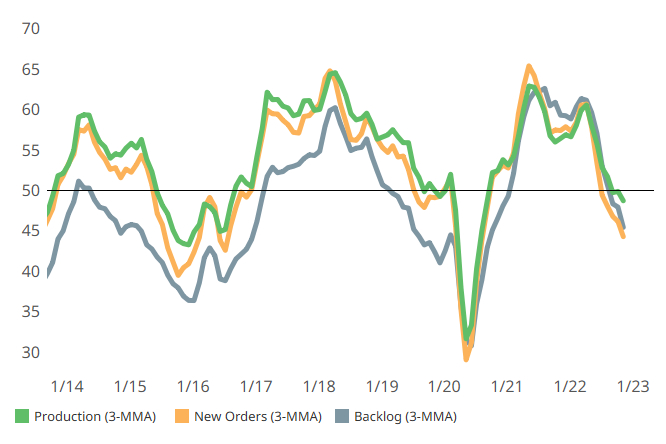

The Metalworking Index for November closed at 47.3, down over two points versus October’s short-lived reprieve of nearly ‘flat’ (49.6). New orders and backlog activity contracted faster in November, with backlog contracting the most as ‘old’ orders were fulfilled. With new orders activity contracting faster in November, production activity started contracting for the first time in over two years.

Employment expansion slowed again in November, but to a lesser degree than most directly previous months. Supplier deliveries continued to lengthen at slower rates, suggesting supply chain issues are less impactful. Export activity contracted at about the same rate it has for three months.

New orders and backlog activity contracted faster in November. Production activity started contracting for the first time in over two years. (3-MMA = three-month moving averages). Photo Credit: Gardner Intelligence

Related Content

-

Metalworking Activity Continues its Roller Coaster Year of Contraction

October marks a full year of metalworking activity contracting, barring just one isolated month of reprieve in February.

-

Metalworking Activity Trends Slightly Downward in April

The interruption after what had been three straight months of slowing contraction may indicate growing conservatism as interest rates and inflation fail to come down.

-

Metalworking Activity Trends Downward in May

Accelerated contraction and declines in business optimism span manufacturing segments. Odds are that broad-reaching economic factors are at play.