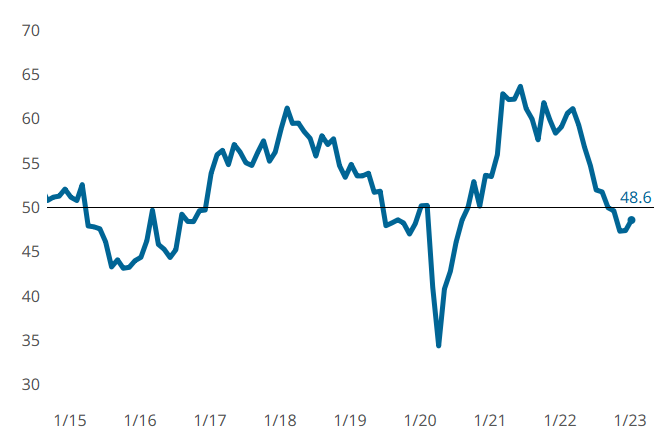

Metalworking Activity Contraction Slows Slightly in January

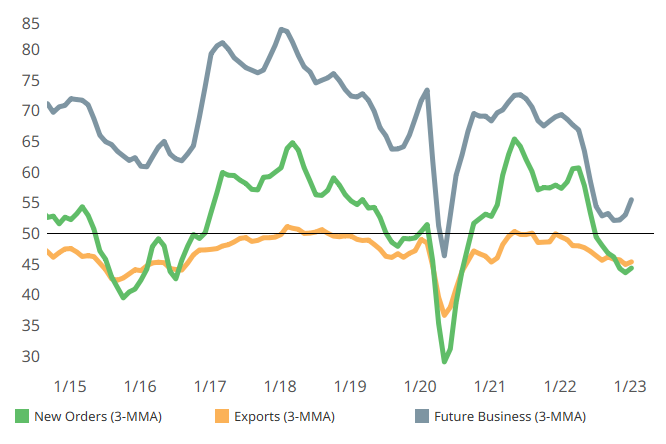

Most components held steady in January, but new orders and exports showed ever-so-slight slowing of contraction.

Share

The Gardner Business Index for Metalworking closed at 48.6 in January compared to 47.4 in December. Most components held steady, but new orders and exports showed ever-so-slight slowing of contraction. Backlog contracted faster again in January, which may be the case until new orders pick up the pace and grow. Production activity paralleled backlog, contracting faster again in January, but maintaining a lower level of contraction.

Employment activity has been threatening to contract for multiple months, coming in essentially flat in January. Reduced hiring needs may be more of a driver of slowed employment activity that, in recent months, has been more a function of an insufficient job seeker pool. Supplier deliveries continued to lengthen more slowly in January, which has been the case for over a year, with no visibility to any ‘normal’ drivers changing the trend near term. ‘Future business,’ a sentiment metric not included in GBI, grew faster in January like it started to in December.

Metalworking GBI contracted again in January, but slightly slower than it had been. Photo Credit: Gardner Intelligence

New order and export activity saw slightly slowed contraction in January. Future business sentiment grew in January, and we will look for the GBI component metrics to follow. (3-MMA = three-month moving averages). Photo Credit: Gardner Intelligence

Related Content

-

Market Indicators Continue to Soften in Metalworking

The overall metalworking index is down more than a point, but future business is up slightly.

-

Metalworking Activity Remained on a Path of Contraction

Steady contraction of production, new orders and backlog drove accelerated contraction in November.

-

Metalworking Index Shows Continued Recovery

December marks third consecutive month of metalworking improvement on the heels of increased supplier deliveries.