The Best Way To Attract And Keep Great People

Most of my consulting time is spent putting together wealth transfer plans for successful business owners. Invariably, about half of my clients bring up two critical and related operational problems: how to keep their company’s top executives and how to attract quality people.

Share

Most of my consulting time is spent putting together wealth transfer plans for successful business owners. Invariably, about half of my clients bring up two critical and related operational problems: how to keep their company’s top executives and how to attract quality people.

My firm's research showed that nearly 100 percent of the top-performing key people have the souls of entrepreneurs. However, for various reasons‚ÄĒusually because they cannot raise the required capital‚ÄĒthese people do not strike out on their own.

Solving the top-executive problem turned out to be relatively simple. The answer was to mimic ownership; to give these key people the same challenges an owner would face and, if they are successful, give them most of the rewards. The top (non-owner) executives that we surveyed wanted four core benefits of ownership. Let’s take a closer look at each of the four desired benefits:

1. Key employees want a piece of the action. Typically, this is a percentage of the profits in excess of a specific dollar amount. Often, the percentage grows as the business and profits grow. For example, Sam Topgun will get 4 percent of all before-tax profits in excess of $200,000 per year. He is entitled to 6 percent when profits are in excess of $400,000. For example, if the amount earned under the plan for the first year (on $350,000) is $21,000, Sam will get about one-third ($7,000) in cash, and the balance ($14,000) is deferred. The deferred portion is invested for Sam’s benefit. Sam receives the deferred portion and the accumulated earnings (side fund) when he becomes disabled, dies or reaches retirement age. The side fund is usually paid out in equal annual installments. For example, if the fund contains $500,000, then it will be paid in ten payments over 10 years or $50,000 per year plus the additional investment earnings for that year.

2. Key employees want disability protection. Employees want to be paid when they are sick or disabled, whether for a day or for a lifetime. This benefit would be covered by long-term disability insurance. It is essential that ‚Äúdisability‚ÄĚ is defined word-for-word in your agreement exactly as it is defined in the disability insurance contract.

3. Key employees want to maximize their retirement benefits. The side fund supplements any regular retirement program (such as a 401(k) or profit-sharing plan). Typically, the executive is allowed to direct the investment of the side fund, which remains an asset of the employer.

Naturally, there will be tax consequences for this arrangement. The side-fund earnings are taxable to the employer. However, when the employee receives a distribution, the company gets a deduction for the exact amount distributed. The employee must report the identical amount as taxable income.

If the employee leaves for any reason other than disability, death or retirement, the entire side fund is forfeited and remains the property of the company. The expression ‚Äúgolden handcuffs‚ÄĚ describes the voluntary restraint the employees in this situation place upon themselves.

4. Key employees want death benefits. When a business owner dies, his or her family can sell the business (assuming it is not transferred to the children). A similar benefit (really a death benefit) should be given to the employee. Of course, this benefit should be funded through insurance.

This article does not attempt to cover every detail and the endless variations for tailoring an agreement that is right for your company. Always, and we mean always, work with an experienced advisor. Based on my experience, I have seen proof that the right agreement will help good employees become even better, but I have never seen an agreement that will make a bad employee even a little bit better.

There is no cookie-cutter solution for keeping good employees. However, the four core benefits for retaining top performers are almost universal.

Related Content

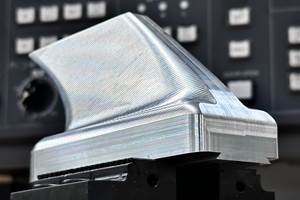

Rethink Quality Control to Increase Productivity, Decrease Scrap

Verifying parts is essential to documenting quality, and there are a few best practices that can make the quality control process more efficient.

Read MoreHow to Determine the Currently Active Work Offset Number

Determining the currently active work offset number is practical when the program zero point is changing between workpieces in a production run.

Read More4 Commonly Misapplied CNC Features

Misapplication of these important CNC features will result in wasted time, wasted or duplicated effort and/or wasted material.

Read MoreCustom Workholding Principles to Live By

Workholding solutions can take on infinite forms and all would be correct to some degree. Follow these tips to help optimize custom workholding solutions.

Read MoreRead Next

AMRs Are Moving Into Manufacturing: 4 Considerations for Implementation

AMRs can provide a flexible, easy-to-use automation platform so long as manufacturers choose a suitable task and prepare their facilities.

Read MoreMachine Shop MBA

Making Chips and 91 ”∆ĶÕÝ’ĺőŘ are teaming up for a new podcast series called Machine Shop MBA—designed to help manufacturers measure their success against the industry’s best. Through the lens of the Top Shops benchmarking program, the series explores the KPIs that set high-performing shops apart, from machine utilization and first-pass yield to employee engagement and revenue per employee.

Read More